Is the AllProWebTools POS is compatible with the new UK VAT regulations that went into effect? Specifically that VAT is now regulated to be charged by the merchant at checkout at the point-of-sale for transactions £135 and under instead of at the point of importation.

We know as a business we need to register with HMRC for our VAT number which is easy to do. But we then have to collect the VAT at checkout from the customer and as the merchant we have to remit the VAT directly to the UK...so can the AllProWebTools POS checkout collect the applicable VAT?

New UK VAT regulatory changes

-

- Joined: Mon Jun 01, 2015 7:55 pm

- Website: www.realnoni.com

-

- Support Team

- Website: www.allprowebtools.com

Re: New UK VAT regulatory changes

There is existing functionality to support creating your own tax rate tables as explained in these videos:

We can consider adding functionality to support UK VAT to the existing Tax Rate system if you can provide detailed information on your specific needs. - Support Team

-

- Website: apwt.realnoni.com

Re: New UK VAT regulatory changes

Ok great. We were not sure how many of your customers do business in the UK/NI and also are impacted. The new UK VAT is already effective. It also appears that of July 1st 2021 all countries within the EU also have changes coming on how EU VAT is collected...but for right now we'll just deal with the UK.

Due the official Brexit the UK and Northern Ireland now have new VAT regulations.

As a merchant for us to continue to be able to sell and ship to UK and NI customers we need to:

Collect VAT at the point of sale in check for all transactions where the sale of goods is equal to or less than 135 GBP, the VAT rate would be 20%. The tax is applied to ONLY the cost of goods NOT the shipping.

For transactions where the sale of goods is greater than 135 GBP we do NOT need to collect VAT at the point of sale.

In addition to being able to collect the VAT we are also required to provide the customer with a full VAT invoice at the point of sale via email and also in print form so that the parcel will be released out of customs once it arrives, if not the parcel will be rejected and returned. The VAT invoice must include:

Everything that is currently on our invoices which I think includes the following:

-Transaction date

-Our business name, address, contact info

-Customers name, address

-A unique order number

-Description of product name

-Unit cost of each product, quantity per product, discounts extended, product total price

-Cost of shipping

We we need to have ADDED only for UK and Northern Ireland:

-Our UK VAT number

-UK VAT rate charged for item

-Order total without VAT

-Total VAT charged

-Order total with VAT

If you could let us know as soon as possible if the AllProWebTools POS can support sales transactions within the UK and NI.

thanks!

Due the official Brexit the UK and Northern Ireland now have new VAT regulations.

As a merchant for us to continue to be able to sell and ship to UK and NI customers we need to:

Collect VAT at the point of sale in check for all transactions where the sale of goods is equal to or less than 135 GBP, the VAT rate would be 20%. The tax is applied to ONLY the cost of goods NOT the shipping.

For transactions where the sale of goods is greater than 135 GBP we do NOT need to collect VAT at the point of sale.

In addition to being able to collect the VAT we are also required to provide the customer with a full VAT invoice at the point of sale via email and also in print form so that the parcel will be released out of customs once it arrives, if not the parcel will be rejected and returned. The VAT invoice must include:

Everything that is currently on our invoices which I think includes the following:

-Transaction date

-Our business name, address, contact info

-Customers name, address

-A unique order number

-Description of product name

-Unit cost of each product, quantity per product, discounts extended, product total price

-Cost of shipping

We we need to have ADDED only for UK and Northern Ireland:

-Our UK VAT number

-UK VAT rate charged for item

-Order total without VAT

-Total VAT charged

-Order total with VAT

If you could let us know as soon as possible if the AllProWebTools POS can support sales transactions within the UK and NI.

thanks!

-

- Support Team

- Website: www.allprowebtools.com

Re: New UK VAT regulatory changes

AllProWebTools tracks all payments in USD only. As exchange rates fluctuate constantly, it would be costly to look up the current exchange rate at the moment of purchase.

Is there a tolerance or variance to the accuracy of the exchange rate at the time of purchase?

FYI: Your sales history shows zero purchases from the UK that were under $190 in 2021 and only 1 purchase in 2020 and 1 purchase in 2019. Orders 54413 and 42814. - Support Team

-

- Website: apwt.realnoni.com

Re: New UK VAT regulatory changes

For VAT the tax is only applicable to the goods, not the cost of shipping. So even though an order total may be over £135 the shipping charge must be removed for VAT calculation purposes.

So this year we actually just had an order last week which is how we discovered the new VAT regulations. Order 58999. the order total is $154.76 but the cost of goods $94.05

There's not really a tolerance the as we have to include a full VAT Invoice which is going to have to breakdown the cost of goods, vat and order total. Orders that are under £135 have VAT charged at time of purchase and are then processed through a different branch of UK border/customs and those orders over £135 are processed through a a separate branch and have VAT handled directly at customs clearance.

If our UK transactions are so few, why would it be costly to look up the current exchange rate at the moment of purchase?

So this year we actually just had an order last week which is how we discovered the new VAT regulations. Order 58999. the order total is $154.76 but the cost of goods $94.05

There's not really a tolerance the as we have to include a full VAT Invoice which is going to have to breakdown the cost of goods, vat and order total. Orders that are under £135 have VAT charged at time of purchase and are then processed through a different branch of UK border/customs and those orders over £135 are processed through a a separate branch and have VAT handled directly at customs clearance.

If our UK transactions are so few, why would it be costly to look up the current exchange rate at the moment of purchase?

-

- Support Team

- Website: www.allprowebtools.com

Re: New UK VAT regulatory changes

This feature request has been escalated and is a priority for the programming team. We will continue to update this thread with progress updates and questions for further clarifications.

Is there a requirement about which currency is shown on the invoice? Is USD acceptable?

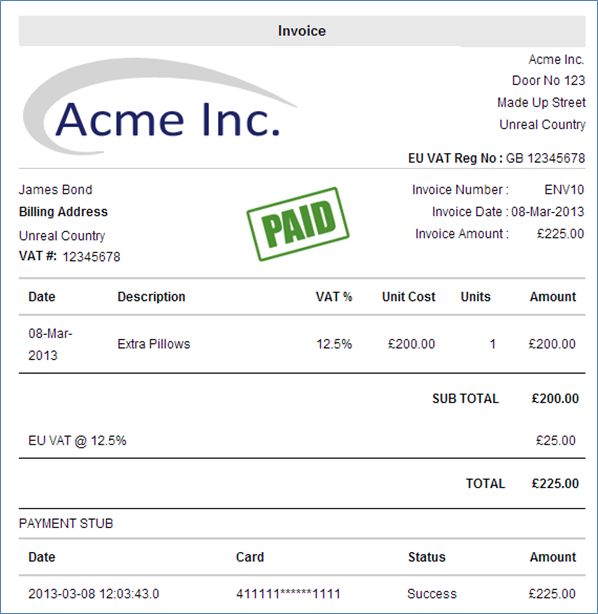

Please confirm if the invoice layout shown here will meet all of your requirements:

- Support Team

-

- Support Team

- Website: www.allprowebtools.com

Re: New UK VAT regulatory changes

Waiting on response from client - Support Team

-

- Website: apwt.realnoni.com

Re: New UK VAT regulatory changes

Sorry our reply took longer as we looked into the format of the invoice example you attached yesterday but it's no longer attached. This new one is an EU invoice and appears to be a B2B transaction as both seller and customer have a VAT # listed...typically it would just be a seller VAT unless it was B2B which we don't do outside of the US and the invoice eg is also not for ecommerce as there's no line item for shipping. The one from yesterday also was not for ecommerce and was missing a number of the items we listed above that need to be on a full vat receipt.

This is what needs to be on the full invoice:

-Transaction date

-Our business name, address, ph #, email

-Our UK VAT number

-Customer name, address

-A unique order number

Product section:

-Date of purchase

-Description of product

-Quantity

-Unit cost

-Discount extended (if applicable)

-Taxable Amount

-VAT Rate

-VAT Payable

-Total Product Price including VAT

Total area:

-Subtotal

-VAT 20%

-Cost of shipping

Total

From looking at the UK gov site the VAT amount has to be listed on the invoice in sterling so GB. Not sure how this is going to work as I know you mentioned the AllProWebTools System only tracks payments in USD?

Is it possible to have the all the product line item pricing in USD but the bottom invoice section with the subtotal, vat rate and amount, shipping, and total in both GB and then in USD as the transaction is going to process in USD correct?

As far as the tolerance for exchange we found out we can use one of two methods for calculating: 1. Current market rate or 2. HMRC period rates of exchange (updated monthly). Sounds like we have to pick one option and stick to it.

-Also we never heard back about why you advised that due to the system only having capabilities to track in USD that it would be costly to look up the current exchange rate at the moment of purchase? But you also advised we actually have very few transactions to the UK, so would it really be that costly?

Please let us know if you need any thing else. This is all new to us as well, do you have any other customers that do business in the UK or EU that are also trying to figure out how to proceed?

This is what needs to be on the full invoice:

-Transaction date

-Our business name, address, ph #, email

-Our UK VAT number

-Customer name, address

-A unique order number

Product section:

-Date of purchase

-Description of product

-Quantity

-Unit cost

-Discount extended (if applicable)

-Taxable Amount

-VAT Rate

-VAT Payable

-Total Product Price including VAT

Total area:

-Subtotal

-VAT 20%

-Cost of shipping

Total

From looking at the UK gov site the VAT amount has to be listed on the invoice in sterling so GB. Not sure how this is going to work as I know you mentioned the AllProWebTools System only tracks payments in USD?

Is it possible to have the all the product line item pricing in USD but the bottom invoice section with the subtotal, vat rate and amount, shipping, and total in both GB and then in USD as the transaction is going to process in USD correct?

As far as the tolerance for exchange we found out we can use one of two methods for calculating: 1. Current market rate or 2. HMRC period rates of exchange (updated monthly). Sounds like we have to pick one option and stick to it.

-Also we never heard back about why you advised that due to the system only having capabilities to track in USD that it would be costly to look up the current exchange rate at the moment of purchase? But you also advised we actually have very few transactions to the UK, so would it really be that costly?

Please let us know if you need any thing else. This is all new to us as well, do you have any other customers that do business in the UK or EU that are also trying to figure out how to proceed?

-

- Support Team

- Website: www.allprowebtools.com

- Contact:

Re: New UK VAT regulatory changes

In reviewing the specifications for this project, it appears this will require a great deal of programming and testing. We have not received any other requests for this functionality. AllProWebTools is built primarily for USA based small businesses who are serving a domestic market. Some functionality does exist to enable international commerce, but this is not the focus for AllProWebTools.

At this time, we cannot justify development of a comprehensive VAT system complete with custom invoices, currency exchange lookups, and country specific price ranges and VAT rates.

In considering that your company processes less than 5 orders per year that meet the VAT criteria, we would make the following suggestion:

We can add functionality that will catch online orders with subtotals under $200 from the UK and NI.

- The customer will receive a message on screen that the order is being held for VAT calculation. They will be contacted by email with a final invoice.

- The order can be held for review by your staff where you can lookup the currency conversion and create a custom VAT invoice using a Microsoft Word Template or similar.

- Your staff can send the VAT invoice by email to the customer along with instructions to update their credit card on file.

- When the customer responds with approval to proceed with the order, you can process the credit card that is securely stored on file for the total amount.

Alternatively, we can provide a custom quote (several hundred dollars in development cost) to add the full comprehensive VAT functionality to be delivered within 90 days. We will need a sample invoice template from you demonstrating all the fields required for a VAT invoice. - Support Team

-

- Website: apwt.realnoni.com

Re: New UK VAT regulatory changes

Thank you for the update.

Yes sounds like the functionality that you suggested makes most sense. Just a question on processing the payment...how exactly will we do this?

Once we've calculated the VAT, sent them a finalized invoice that we've created in a template (no within AllProWebTools) and asked the customer to update and store their credit card on their customer profile...how exactly will be able to charge the finalized total amount in the AllProWebTools system? We won't be able to charge the total directly in Authorize as we would need the full card details and the AllProWebTools system x's everything but the last 4 digits. We've never used the AllProWebTools system to create an order simply by imputing the total to be charged....how do we do this?

Yes sounds like the functionality that you suggested makes most sense. Just a question on processing the payment...how exactly will we do this?

Once we've calculated the VAT, sent them a finalized invoice that we've created in a template (no within AllProWebTools) and asked the customer to update and store their credit card on their customer profile...how exactly will be able to charge the finalized total amount in the AllProWebTools system? We won't be able to charge the total directly in Authorize as we would need the full card details and the AllProWebTools system x's everything but the last 4 digits. We've never used the AllProWebTools system to create an order simply by imputing the total to be charged....how do we do this?

-

- Support Team

- Website: www.allprowebtools.com

- Contact:

Re: New UK VAT regulatory changes

You can create a new product like "Vat Invoice" and enter it as a line item as you would when entering a manual order. You can even put a reference number to the Custom Invoice number into the "description" field for later reference. You can adjust the item price to the total of your custom invoice, then charge the card on file.

When you create the new product, you would set it as "private" (not "public") with the switch at the top right so that it does not appear to your customers on your website. - Support Team

-

- Support Team

- Website: www.allprowebtools.com

- Contact:

Re: New UK VAT regulatory changes

This feature has been built and is now added to version 5.72. Version information and estimated release date can be found here: viewtopic.php?f=5&t=4497&p=10136 - Support Team

-

- Support Team

- Website: www.allprowebtools.com

- Contact:

Re: New UK VAT regulatory changes

Your account has been upgraded to the Beta version 5.72 as we release the new VAT feature. Your feedback will be valuable as we test this new feature.

Please customize the webpage that will notify the customer that they cannot complete the transaction and that it is being help for VAT assessment and review. You will find the page to be customized on your main menu by going to: webpages -> My webpages. Search for the page titled "[SYSTEM] - VAT Page" - Support Team

-

- Website: apwt.realnoni.com

Re: New UK VAT regulatory changes

Oops! An order from Great Britain made it through? Usually we get a email notification that we have a customer wanting to place an order and need to address the VAT....buyer #8804. Any ideas why this order didn't trigger the VAT feature?

-

- Support Team

- Website: www.allprowebtools.com

- Contact:

Re: New UK VAT regulatory changes

Order# 63296 was for the amount of $315.08.

Please reference the post earlier in this thread on the date Thu Jun 10, 2021 8:40 pm to see the threshold amount that was specified where it says " subtotals under ". - Support Team